Buying a house in Thailand

Overall property laws and buying a home in Thailand has its own specifics but basically is not much different from buying real estate in other countries like Germany, Australia, or the US, except foreigners may not own land in Thailand. Land ownership in Thailand is governed by the Land Code Act. Foreign land ownership restrictions in Thailand land laws refer to the land only, not the building on the land or condominium registered under the Condominium Act. The land and the structure on the land could be owned independently by separate persons. Foreigners buying a home in Thailand can do this through a 30 year land lease agreement (and optional right of superficies) with the house owned as a separate personal property.

How to own a house distinct from the land it is on

In a standard situation a real estate sale in Thailand involves land and house. The owner of the land is the owner of the things fixed to it or forming a body with the land (section 139 Civil and Commercial Code). There are exceptions, and for example in case of a foreigner buying real estate in Thailand ownership of a house can be registered and transferred separate from the land it stands on. In case ownership of a house is transferred separate from the land the transfer procedure must be in accordance with the Thailand Civil and Commercial Code (Book IV 'Property') and:

- be in writing, and

- registered with the Land Department's branch or provincial office.

Buildings (apart from condos in a licensed condominium building) do not have a separate ownership deed in addition to the land tile deed. The procedure to obtain ownership of a structure/ building or house separate from the land is as follows (note: the rights to use and possess the land (land lease and/or superficies) must be created first):

- If buying from a developer (depending on the sale and tax structure and liabilities the developer chooses) the sale of a house separate from the land lease is either by:

- a land lease and a building sale and purchase agreement followed by the land office transfer procedure (see under 3), or

- a land lease and a building construction contract (hire of work) with a building permit in the foreign purchaser's name.

- In case an individual person is developing a plot of (leased) land the building permit should be issued by the Or Bor or in the name of the person that leases the land (the building permit can be used as proof of ownership of the house).

- Sale and transfer of ownership of an existing building separate from the land requires the current owner and purchaser of the house to:

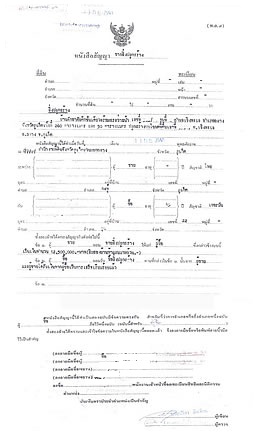

- sign a standard land office Thai script sale of a structure document, signed at the land office in front of the competent land official (this official document is used as proof of ownership of the house)

- followed by a 30 day public announcement/ posting of the house sale at specific locations

- after the announcement period the parties return to the land office to complete the transfer (the Thai script sale of a structure agreement will stamped and issued by the land office and can be used as proof of ownership of the building)

- property transfer taxes and fees must be paid (each party pays a share based on the agreement between the parties)

If the above procedure has not been followed the building could legally still be owned by the developer or another third party who owns the land and built the house (not recommended) - read more: buying and building a home in Thailand

Documents required for the transfer:

- passports/ ID-cards

- land title deed

- house book (tabien baan)

- building permit

The sale of an existing house separate from the land (land lease combined with house ownership) must be registered with the local land office to be complete and transfer fees and taxes must be paid when the transfer takes place. The land office is the only government authority in Thailand for the administration and completion of a transfer of ownership of a building. The transfer will take at least 30 days (announcement of the sale period) from the first visit to the land office to the issuance of the sale of a structure document. The 30 day announcement period is to see if anyone wishes to contest the ownership over the house. The issued Thai script sale document stamped and signed at the local land office (sample right column) is the document that proofs the purchaser's rights to the house. The sale of land and house and the transfer of land with a full title deed and building on the land together is completed om the same day - read more (building yourself)

Right of superficies, as a separate registered right in addition to a land lease agreement, is not common in Thailand. Superficies is used when the owner of the land is not the same as the owner of the house erected on the land. A right of superficies is registered on the land title deed - read more...

The Thai House Book

A Thai house book (Ta.Bian.Baan - read more (external)) should not be confused with a house ownership document. A house book is only a house address and resident registration document issued and administrated by the local government district amphur. This is not an important document for foreigners and unless the foreigner has residency in Thailand he is not registered in a blue house book, even though he is under Thai law regarded as the legal owner of the house. A special yellow house book for foreigners can be obtained and depending on the location the requirements for issuing a yellow book could include a work permit or Thai marriage certificate, non-immigrant visa and ownership document (condo title deed or the land office sale of a structure document). The document that could be described as the house ownership document (separate from the land) is the building permit (issued by the local Or.Bor.Tor) or the Land Office sale of a structure document issued by the Land Department.

Building permission for a house in Thailand

The seller of the house must also have approval for the building (construction permit). The government issued building license is the evidence that shows the seller owns the building and obtained approval to build on the land (it does not say that the building is built according to the building permit!). If the seller can't show a building approval the house could be illegally built or may not be built according to local building or zone regulations. Unregistered houses or houses liable for demolition (conflict with the Building Control Act or zoning regulations) have been sold to foreigners in Thailand - read more...

Term of ownership of a house on another man's land

The right to own a house separate from the land always follows the term of the land lease and/ or superficies agreement. The contract for a land lease and/ or superficies can run for a term not more than 30 years or for the life of person or person's granted the right of superficies. If the land lease/ superficies is near termination the use and possession of the land can be renewed (the owner willing to renew it). The contract may contain a renewal option but as a mere personal contract promise that can only be enforced at the time when the registered lease term runs out this must be considered unenforceable as a contract - read more...

Thai property taxes: land and housing tax

When a land and house lease agreement is put in place (or land and house is owned by a company) land and housing tax shall be collected at the rate of 12.5% of the yearly rental according to the lease agreement or the annual value assessed by the Land Department - read more...

Ownership transfer of a house: land office tax and fees

The transfer of ownership of a house is as an immovable property subject to income withholding (personal or corporate income) tax, transfer fees, stamp duty, specific business tax calculated over the registered sale value or appraised value. The government's assessed (appraised) value of a house used by the land office depends among others on location, number of floors, floor space and materials used - read more...